Real Estate Predictive Modeling: Making Informed Decisions

Real estate predictive modeling has emerged as a powerful tool for real estate professionals to make data-driven decisions. This article explores the concept of predictive modeling in the context of the real estate industry and its significance in guiding strategic choices for property investment and marketing.

Understanding Predictive Modeling:

Predictive modeling involves the use of historical data and statistical algorithms to forecast future outcomes. In the real estate context, predictive models analyze various data points, such as property attributes, location factors, market trends, and economic indicators, to predict property prices, rental demand, and other relevant metrics.

Benefits of Real Estate Predictive Modeling:

1. Improved Investment Decisions: Real estate investors can use predictive models to assess the potential ROI of a property accurately. By considering factors like property appreciation, rental income, and market trends, investors can identify lucrative investment opportunities.

2. Optimal Pricing Strategies: For sellers and agents, predictive modeling can help determine the most appropriate listing price for a property. Accurate pricing can attract potential buyers and facilitate faster transactions.

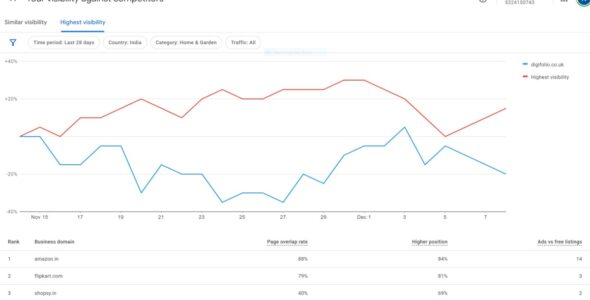

3. Targeted Marketing Campaigns: Predictive modeling enables real estate marketers to identify the right audience for specific properties. This targeted approach enhances marketing efforts and increases the likelihood of attracting qualified leads.

Data Collection and Preparation:

To build effective predictive models, real estate professionals must gather relevant data from various sources, such as Multiple Listing Services (MLS), property databases, demographic data, and economic indicators. Ensuring data quality and preparing the data for analysis are crucial steps in the predictive modeling process.

Selecting the Right Algorithms:

Choosing the appropriate algorithms is essential for accurate predictions. Regression analysis, decision trees, and machine learning algorithms are commonly used in real estate predictive modeling. Each algorithm has its strengths and weaknesses, and selecting the right one depends on the specific use case.

Evaluating Model Performance:

Once the predictive model is developed, it is crucial to evaluate its performance. Real estate professionals must validate the model’s accuracy and adjust it as needed to improve its predictive capabilities.

Challenges and Considerations:

While predictive modeling offers significant advantages, there are challenges to overcome. Data privacy and security concerns, data accessibility, and potential biases in data collection are some of the critical considerations for real estate professionals.

Conclusion:

Real estate predictive modeling provides invaluable insights that empower professionals to make informed decisions, whether it’s identifying lucrative investment opportunities, setting optimal property prices, or targeting the right audience for marketing campaigns. By harnessing the power of data and advanced analytics, real estate professionals can navigate the market with confidence and gain a competitive edge in the dynamic real estate landscape.

[…] Real estate predictive modeling has emerged as a powerful tool for real estate professionals to make data-driven decisions. […]